– Team MPRC, IIM Kashipur –

We are in the age of data science. The ever-growing complexities of data science welcome a whole new scope to unlock the power of data. With big data rising at an exponential rate, it is becoming essential to organise, filter, analyse, and visualise data to gain a competitive edge in the business. Data visualization is gaining traction. According to Gartner, by 2025, data storytelling will emerge as an industry trend, with 75 percent of the stories automatically generated using augmented analytics techniques.These techniques are at the center of revolutionising the sense of looking at data differently and thereby enhance the experience of analysing data.

Prof. Vivek Anand talks to the Media and Public Relations Committee (MPRC), about the scope of data visualization for the managers of tomorrow, and more.

Prof. Vivek Anand is currently associated with Wilson Consulting Private Limited as an operations director. He is a data visualization consultant with 17 years of experience and has done MBA from Monash University Melbourne Vic. with an area of specialization including Marketing & Econometrics. He has a background in Sales & Marketing with leading Indian hospitality brands across the country. His inclination to analytics made him switch roles 8 years ago to become a full-time consultant in analytics and spearhead corporate training for Wilson Consulting in India and the US. He is a qualified trainer of some leading tools in the industry such as Tableau & Power BI and has a passion for teaching. He is also an adjunct or visiting faculty at Great Lakes Institute of Management, Great learnings, SP Jain, IIT Madras, IIM Kashipur, IIM Calcutta, IIM Trichy, IIM Ranchi, IIM Kashipur.

[MPRC]– What is data visualization? How important is it today?

[VA].- So to give it to you in a nutshell, Data Visualisation is trying to look at data or trying to see or perceive patterns in the most effective manner. That’s what it is. It’s not a tool if I may say, I would rather call it science and I think it forms a vital part when it comes to business operations because we are moving into a phase where data is becoming the key. One of the biggest challenges that organizations face is how to best organize data, how to best seek patterns and once you find a pattern, the next task is how to best present it as a story or a dashboard or something. So I would say it is extremely crucial when you want to kind of make any sense of the data.

[MPRC]– How is this science helping the managers to perceive a pattern?

[VA]– When you are trying to perceive a pattern, the intent is to try and get the answers. The interpretation must happen as quickly as a reflex action. Say, for example, you are made to touch a 500 degrees Celsius hot iron ball, your spontaneous reaction would be to take a hand off the ball. Now, you need to have a similar kind of reaction when you see data. Without even thinking for a second, you must be able to get the answers as quickly as you can without having too much hand-holding or too much help. That’s when you know that you have actually got it right. And also the thing is no one has the time or bandwidth to really sit and ponder old things to see what it was all about. So if we don’t get things right, we won’t get that kind of reaction from your audience.

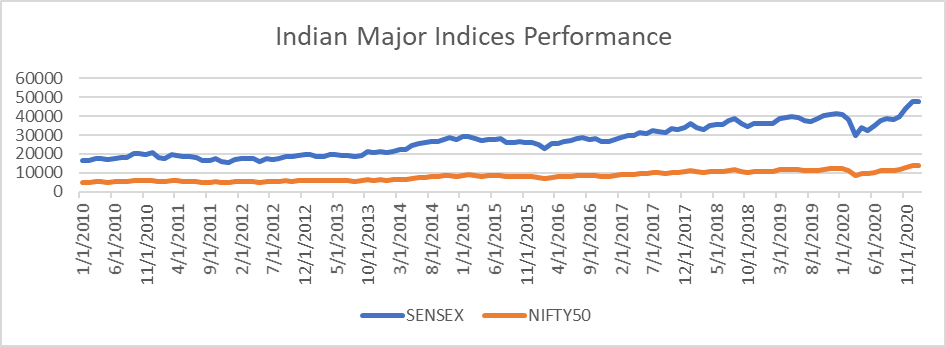

[MPRC]– From a managerial point of view, prior to 2010, there were not many tools for data visualization. As we remember when we were in school, we were still using PowerPoint and it was just the beginning. But right now a lot of software has come up. So which software is used in the market right now?

[VA]. – Okay so, I’ll give you an answer for a software. There are so many tools like Tableau to lead with today. There is Power Bi for rich visualization and multiple other tools like Qlikview etc. A lot of tools are there. There are tools which are user-friendly, like drag and drop feature. Some of them require a bit of coding. But, I would say that learning software is not going to give you science. Just to tell you something, whatever that can be done with all these cutting-edge tools, can also be done with Microsoft Excel. It is just that it needs a little extra bit of time and effort.

The tool is not again a bit of a challenge because a tool which is learnt at the drop of a hat today might completely transform tomorrow. So tools should never be a constraint for learning and that is something that I keep telling everyone, organizations and students especially. To students, I advise that don’t worry about the tool at all but rather learn science. Transfer science to whatever tool you have. If an organization has an XYZ tool and you do not have any other choice, you still have to make do with what you have. So that’s something that I always believe in.

[MPRC]–Has there been any instances where this data visualization science has helped you or your clients in figuring out problems that might not have been possible with traditional approaches to data handling?

[VA] – Actually yes. Quite some time back. In fact when I was working for one of the hotel chains. I had joined the company recently and I was looking at its past years’ data performances and all that. We realized that the hotel was dipping very largely in terms of occupancies. Now, there were a lot of reasons as to why the occupancies were dipping…so on and so forth. Oh! I still remember the charts very vividly in my mind. We had access to a lot of reports from hotel agents, something called a spy report and a lot of other reports, basically numbers. We realized that when we actually did a very effective visual technique, we were able to see how the market is trending. We saw that the market was still growing at a very rapid rate. Everybody was growing except for the company that I worked for. So that was where the problem came about and we realized that it was not the market that was not growing but we were the one not growing. So the next move was to find who is actually the one who has kind of taken away from us and who is doing better. There were multiple lines. We saw that the year that we started having dips in occupancy levels, a couple of chains were actually gaining momentum and there was a very inverse proportion. As ours was dipping down, we saw that they were growing better and better. So that was a very fantastic and early indicator that I saw, the way things are actually coming up pretty well. Another example that I can share is one of the companies that I had worked for. They worked in a manufacturing setup; safety is of utmost importance. It was a US-based company so all the more reason they were very paranoid about safety than a lot of other folks because of a fear of lawsuits or claims. We were able to foresee how accidents were likely to occur. So the kind of visual that we created came with an effective technique which captured a lot of factors indicating a potential accident. We had to take a lot of corrective actions. So that kind of really averted a potential crisis. I mean nothing happened in the end of it but there were a lot of indicators based on things. So that’s another fantastic example that I can think of. There are so many examples we stumble upon every day but these are two diverse examples where I can think of applications.

[MPRC]– What would you suggest for the managers who are interested in data science and visualization and how they can develop this knowledge?

[VA]– See again, there are two kinds of audiences that one can talk about: a person who creates an actual report and the other who consumes the report. So a report consumer needs to have a different set of skill sets and the one who is going to create the report must have slightly different skill sets. I am assuming if a person is a manager and he may have someone working for him or maybe he is a director or VP of a good company, I don’t expect him or her to learn technology. For example, suppose you got a platform which requires complex coding. All you need to do is know that you have to understand how to read the results and absorb it. That’s the kind of learning that I would recommend a manager to get himself or herself acquainted with. If you are a marching soldier and you are the one who is going to create the reports, then you need to have a couple of tools. First of all, you need to have the technological input. You need to also have the science of visualization. While you have the science, you also need to make sure that you do things right. You must be one step ahead of the manager. Therefore, the one who is developing should be twice as smart as a manager. That’s the irony but then that’s how things work.

So in terms of decision-making, you want to support the manager with the right quality of output so that they are able to absorb. And of course, with their experience in the business, they will make the right decisions.

[MPRC]– So in your opinion at this moment, what is happening in the industry? Do you think that the data visualization is not being given the importance as it should have been?

[VA] – The thing is…it’s the mindset of a lot of people. To give you a little insight into it, the particular clients that I have been dealing with, they had a very stereotypical mindset. They are the ones who have not been able to think beyond what they have been doing. So for them, it is a concept selling that you still have to do. I think they are happy in their own space. They are happy with what they are doing and they don’t really wish to evolve into the next level. So there is nothing that you or I can do. But having said that there is also another whole bunch of cohorts where things are very different, where people are actually now adapting to this entire concept. They are embracing this whole idea. They want to really see how to make it fit into the reader or the business operations. They are getting very data-driven. But everyone does not have the skill set. Because that’s a different piece altogether that one has to know. But this is starting to grab people’s attention and the trend is changing. I can see it’s slowly changing.

[MPRC]– When did you realize that you should pursue a career in data visualisation?

[VA] – So I must admit I am not the brainchild behind this particular thing at least as far as I am concerned. I must owe this to my brother who is taking a leap more than I did to take it back to where we started. To give you a background, he used to work for a utilities firm back in the US. I think he was more on the supply chain side. Back then all that they were doing in his team was simply reporting. They were just getting reports and putting them in different forms. Nobody was really taking any sort of action with the data. So I think what he actually did from there in the early 2000s is to start to take some actions on data. It was a very rudimentary technique to really get going with how to generate some meaningful insights from the data. Back then I think they would not do it anywhere. There was not a lot of content. there was not a lot of technology also to support something in this space. Simultaneously, while my brother was working in the US. I had gone to do Master’s in Australia and I also picked up a sense for Analytics. So to be very honest that’s when I kept hearing things on a very similar note. We also had a lot of exchange students from the US. We interacted with some folks and we understood that there was a buzz. There is going to be some sort of explosive technologies. We could pre-empt. People are talking about it that this is going to be big. There was a lot of hype getting built in its own capacity. So that’s when I started to think about this as a thing. I said, maybe this could be a potential career path, but I guess for me what happened was I was basically inclined into analytics and I found that this was a very useful feature or a very useful skillset to have if you are going to get into the analytics profession. So as a career path, yes, that’s when the whole thing I can take it back.

[MPRC]– So you have been in the industry for almost the past 10 years. Based on that, what is your opinion about the industry trends or the career option which anyone can have in this field?

[VA]. – A career path just on data visualization alone is something where I would not put all my eggs in one basket. This has to be in combination with all your other learnings. So today, If you want to make a career path in this alone, it’s a very slim chance. Because right now, as a student if you try to set a career for the first time, you need to be a jack-of-all-trades, you can’t just be a master of none. It happens over a point in time, once you have your expertise. So right now, my recommendation is to learn everything. You don’t know when what will come in handy. Because you need to have your skill set in analytics, data mining, business analytics, forecasting etc. Put all your regressions, your modelling techniques and you should be able to combine visualization as a part of your data model as well. If that works well, I think it is a fantastic career path.

(Prof. Vivek Anand teaches data visualization at IIM Kashipur).