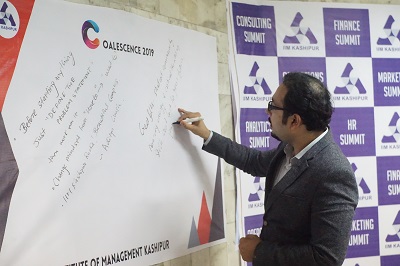

Corporate competitions had always been a key area of focus in my MBA journey as they gave me a platform to take my classroom knowledge to the real world. Having worked in a fortune 500 organization I was always fascinated with the use of technology to elevate the human experience and hence E-Commerce was a domain of my interest. When Flipkart launched its flagship B-School competition Wired I pounced on the opportunity to apply my acquired management knowledge backed up with my technical skills to solve challenges faced by a giant like Flipkart. Since I was preparing for this competition for a long time (and well yes, the chance of scoring a PPO made it more lucrative), I was closely following the developments in the E-Commerce supply chain industry regularly. After understanding that how crucial E-Commerce had become to an average Indian in the times of COVID-induced lockdown, I wanted to dive deep into the sector and develop models on how E-Commerce can penetrate in a challenging country like ours.

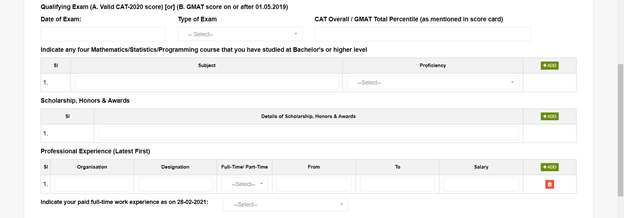

The case competition required us to develop a model using which Flipkart could cater to the Tier 2 Indian customers with their day-to-day purchase needs. Understanding the importance of this problem statement in the context of Flipkart’s business situation and the national lockdown scenario, our team’s objective was to design an easy to implement supply chain model that could be easily replicated across the country within a time frame of 1 year. After clearing a series of rounds our team had the absolute delight to reach the national semifinals of this coveted competition. The very fact that this competition provided me with a platform to present my solutions and ideas to the top leadership of a dynamic organization like Flipkart tremendously added to my learning curve.

Having missed a chance to be a part of the National Finals, I was overwhelmed when I was called up for an interview with Flipkart in the form of a pre-placement interview (PPI). Well as Flipkart rightly claims “Ab har wish hogi poori” they certainly fulfilled my wish by providing me a chance to kick start my career with an organization like theirs. The interview process which had three rounds (a general aptitude test followed by 2 rounds of interviews) gave me enough opportunities to understand how I as an individual could contribute to Flipkart (technically and behaviorally). The interviewers were very keen on understanding what skill sets I bring to the table and what do I look for in terms of growth and opportunity. After those three rounds of virtual interactions, I finally got to experience that most sought-after day of MBA life when finally Flipkart offered me THE job!

The entire experience of participating in corporate competitions, learning bit by bit in each of them is a continuous journey. A journey that I believe is different for every individual. I cannot be thankful enough to be a part of an institute like IIM Kashipur where the entire atmosphere focuses on making you ready for real-world challenges. With competitions taking the center stage of academic focus it was my institute that played the pivotal role in grabbing my dream job opportunity.

About the author :

Pranav Bhardwaj is currently pursuing MBA from IIM Kashipur, with majors in Analytics and Marketing. He is a part of various student bodies like the The Consulting & Strategy Club, TEDx IIM Kashipur and Prep Cell. You can connect with him on LinkedIn.