Few lingering questions which every common investor has in his mind are how can the stock markets and the economy growth move in the opposite direction? Will the market crash due to poor economic growth anytime?

While the Covid-19 pandemic forced all economic activities to a total halt, pushing major economies into a recession, the markets around the world on the other hand had a mixed response showing a steep fall during the initial pandemic breakout and steadily recovering over time to race all-time highs in Indian and US exchanges.

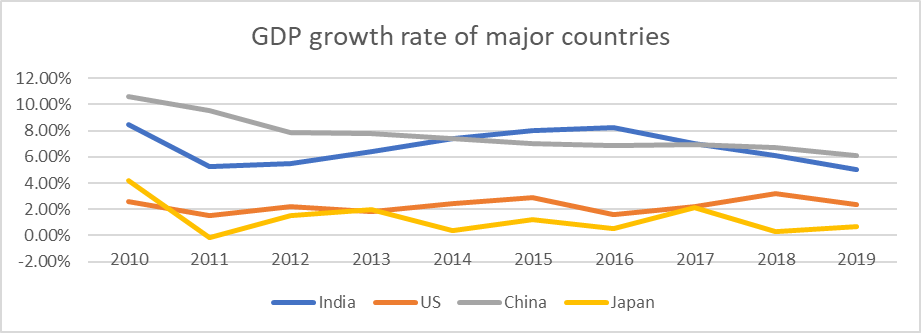

The empirical analysis of the annual GDP growth rate and the historical market performance of leading stock exchange indices of major countries such as USA, Japan, China, and India respectively over the decade show little correlation between the growth of countries’ GDP and performance of stock markets.

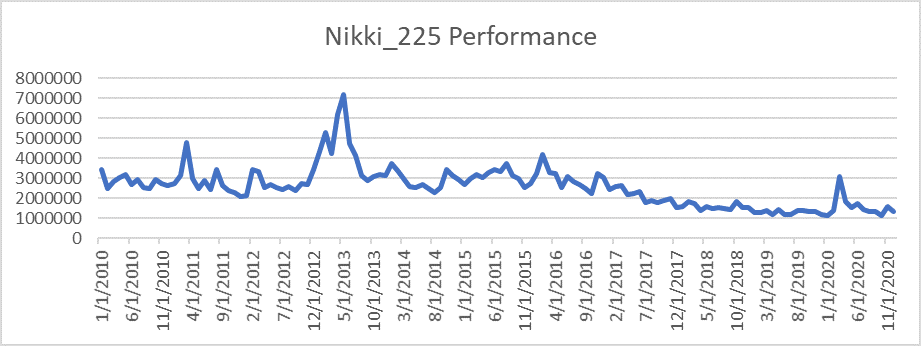

Japan faced one of the worst decades of economic growth battling recession and unemployment having a maximum GDP growth rate of a mere 2% in the last decade. While Nikki_225, the benchmark index of the Tokyo Stock Exchange had lost more than 60% of its value over the decade, sharp falls in the index during this period was the result of external events such as Fukushima’s nuclear crisis and the European Sovereign Debt crisis in 2011. The rally in 2013 which surged more than 70% due to the weakening of Yen and expansive economic policy was short-lived as the market plunged by ~60% at the end of 2013 due to the weak GDP growth of China and quantitative easing of US Federal Reserve during the same period.

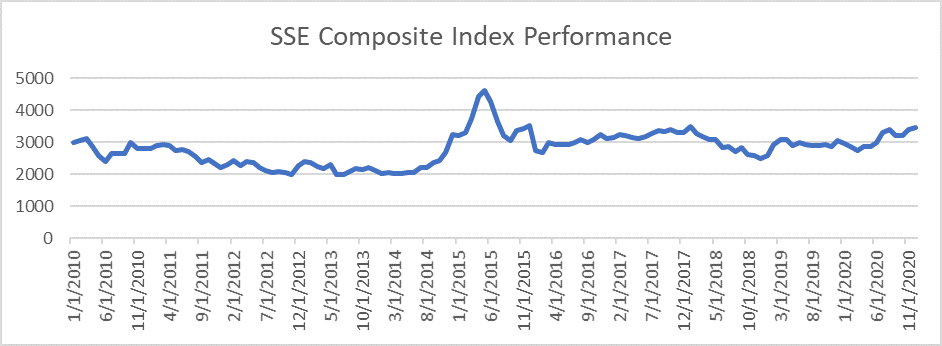

Though China’s economic growth declined gradually from 10% to 6% over the decade, it was still having the highest growth rate among the developing countries. The Shanghai composite index grew a mere 16% over the decade despite the country having the highest GDP growth among the major economies. The Chinese exchange majorly influenced by the domestic investors who were largely inexperienced and traded using borrowed capital persuaded by the Chinese state-owned media during the period of 2015, saw a bubble in the market with the index soaring more than 150% over the previous year despite the country having poor manufacturing and economic growth. However, the bubble was short-lived and consequently busted as it lost 40% of the value in the month of June and continue to fall subsequently due to the devaluation of Yen.

The turbulence of Chinese stock markets combined with slowing growth of China’s GDP, falling oil prices, and weakening of the Japanese Yen against the US dollar and Brexit event resulted in a global sell-out during the period of 2015–16 which impacted all major stock markets around the world including US and India.

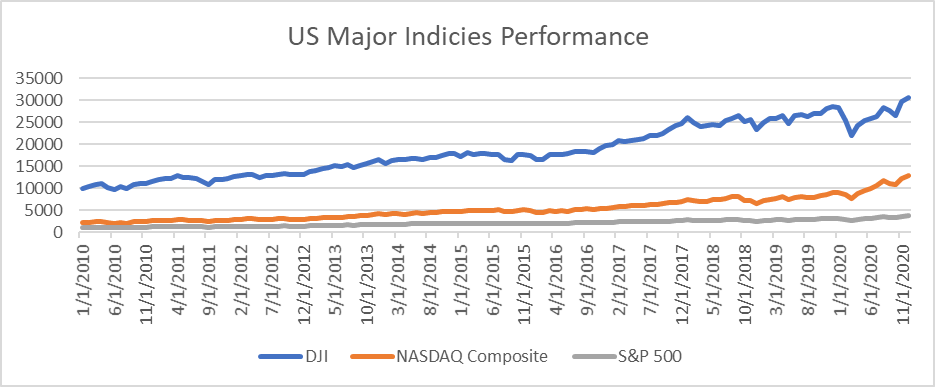

Despite having low GDP growth of around 2% over the decade, US markets have continued to grow over where the leading indices such as Dow Jones Industrial average, S&P 500 and NASDAQ Composite have yielded returns of over 200% primarily driven by innovation and technology. FAANG companies due to the power of the platform model, network effects have had a compounded annual return of more than 20% individually over the decade. Markets also saw an emergence of new business models and sunshine sectors such as electric vehicles, e-commerce, AI & Cloud computing, alternative energy, OTT etc which continue to have positive investor sentiments.

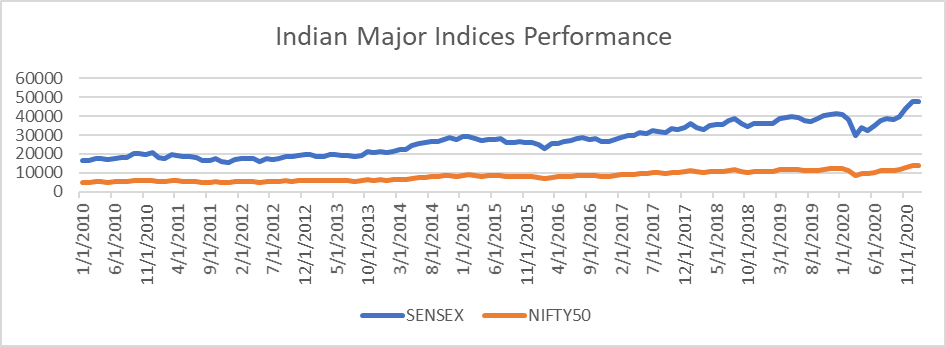

Globalisation and foreign trade are also important factors to consider why the performance of the Indian stock markets has little correlation with economic growth as the manufacturing sector contributes only ~15% of total GDP compared to China and Japan which has ~ 30% and ~20% respectively. The major sectors such as IT, Pharma, Breweries and Distilleries, Precious Metals, Automobiles are export-oriented which relies on the US and the global economy. Sectors such as Refinery, Paint, Aviation are highly dependent on the price of crude oil as India is one of the major importers.

FII also has a significant factor to play in controlling the direction of the stock markets. Indian equities saw a record inflow of $23 Bn (Rs. 1.6 Lakh Crore) in 2020 as the global investors were optimistic about the strong economic recovery, vaccine progress and low mortality of Covid-19 in India compared to western countries. This liquidity provided by FII continues to drive the market sentiments forward leading the prices to soar all-time high across multiple sectors.

The performance of the stock markets does not rely only on the economic growth of the country. Other factors such as the nature of its constituents, the impact of FII, technology & innovation and global events can also impact the markets. Markets can be both forward-looking and reactive to economic events and will correct themselves in the event of any bubble during times of weak economic growth.